property tax assistance program illinois

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. A lawyer may be able to help a homeowner enter into a payment program.

Cook County Treasurer S Office Chicago Illinois

This page is your source for all of your property tax questions.

. An exemption reduces the property s assessed value and may be in the form of a percentage of that value or a reduction of that value. The property must be occupied for 10 continuous years or 5 continuous years if the person receives assistance to acquire the property as part of a government or non-profit housing program. INCENTIVES AND TAX ASSISTANCE.

So if a propertys EAV is 50000 its tax value would be 40000. Macon County Property Tax Information. If a home has an EAV of 200000 its tax value would be 190000.

Apply for a Loan Apply for a loan through a bank or property tax lender. Sales of tangible personal property to interstate carriers for hire used as rolling stock ie. The loan from the State of Illinois is paid when the property is sold or upon the death of the participant.

The Illinois Department of Revenue does not administer property tax. Illinois Property Tax Assistance Program is available for property owners who need help today. The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges.

Aand information on financial assistance programs for elderly Illinois residents is available here. Welcome to the Illinois Tax Assistance Website We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. There may be some assistance available for delinquent property taxes in Winnebago County Illinois.

As mentioned above property tax relief mechanisms generally provide relief by exempting a portion of a property s assessed value from taxation or abating the amount of taxes paid. The Senior Citizen Real Estate Tax Deferral program is a tax-relief program that works like a loan. Call us today to find out if you qualify for one of our progra.

Department of the Treasury on its Illinois Homeowner Assistance Fund ILHAF program to provide assistance to Illinois homeowners who have struggled to pay their mortgage due to COVID-19. Social services might have special loan or grant programs available for the payment of past due property taxes. Overview of the Illinois Hardest Hit Fund known as the Emergency Loan Program.

I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance Web page to learn about what assistance may be available. Maria Pappas Cook County Treasurers Resume. The Program will provide 560 million in property tax relief and 453 million in pharmaceutical assistance to Illinois senior citizens.

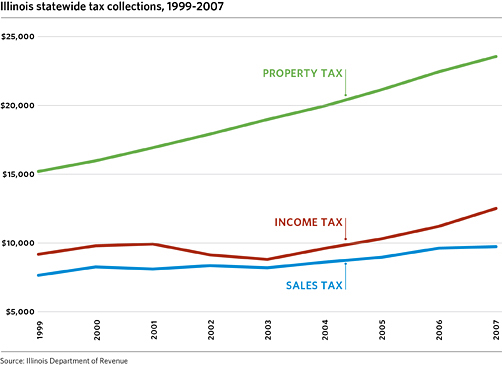

Cook County announces property tax relief for County property owners Wed 05132020 - 1200 Taxes Recognizing the financial toll of the coronavirus and the pressing need to extend economic relief to area homeowners Cook County Board President Toni Preckwinkle announced Wednesday plans to waive late fees on property tax payments. Property Tax See Table 27 Sales Tax. Jan 22 2010.

Illinois property tax bills are on their way and payment is due in June. There are many offices that hold different pieces of information about your property tax and this page is intended to get you to the answer with as few clicks as possible. The program will provide low to moderate income homeowners in Illinois a zero percent interest loan that needs to be used to pay their housing expenses such as their mortgage property taxes insurance and other expenses.

With many families and businesses losing income due to the stay-at-home order amid. Semi-tractor trailers railroad cars Property held or used for business or production of income commonly known as tangible personal property Items Subject to State Tax. The Senior Citizen Real Estate Tax Deferral Program.

To see if you qualify give us a call today at 312-626-9701or fill out the form below to have one of our representatives give you a call. Maria Pappas Cook County Treasurers Biography. Check If You Qualify For 3708 StimuIus Check.

FORMS OF PROPERTY TAX RELIEF. 2022 Latest Homeowners Relief Program. Most states provide low income families with free advice as part of the federal government funded Legal Services Corporation LSC.

Personal and Corporate Income Tax. Duties and Responsibilities of the Cook County Treasurer. Additional grant programs and access to loans can assist your business with working capital machinery and equipment land acquisition.

The homeowner or homestead exemption allows you to take 10000 off of your EAV. State of the Office. This exemption limits EAV increases to a specific annual percentage increase that is based on the total household income of 100000 or less.

Beginning January 1 2001 legislation will take effect that may significantly increase the. 31 rows Purpose of the Property Tax Relief Program. I hope this information helps you Find.

It allows qualified seniors to defer a maximum of 5000 per tax year this includes 1st and 2nd installments on their primary home. It is managed by the local governments including cities counties and taxing districts. Illinois has received approval from the US.

The 10000 reduction is the same for every home no matter its market value or EAV. Freedom of Information Requests. Another possible source of assistance in dealing with back property taxes may be a free pro-bono attorney.

If you are a taxpayer and would like more information or forms please contact your local county officials. Starting in April 2022 the state will begin accepting applications from homeowners for grants of up to 30000 to eliminate or reduce. The money can be used by the client of the program for up to.

Illinois offers a competitive range of incentives for locating and expanding your business including tax credits and exemptions that encourage business growth and job creation.

Illinois Property Tax Exemptions What S Available Credit Karma Tax

Covid 19 Faq Cook County Assessor S Office

Property Taxes By State Embrace Higher Property Taxes

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Property Tax Relief How It Works Credit Karma

Gov Jb Pritzker S Budget Plan Offers Tax Relief Wbez Chicago

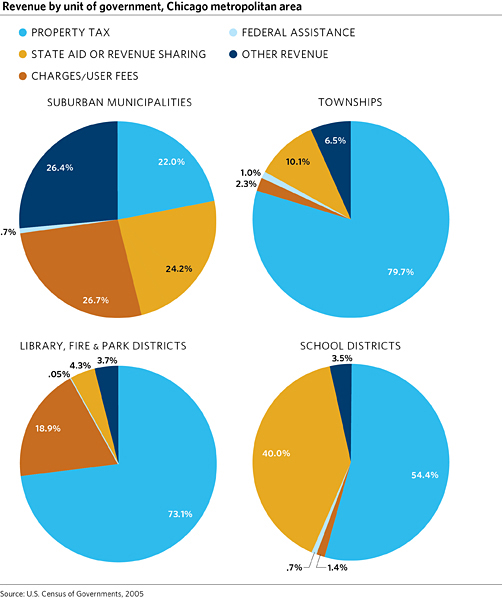

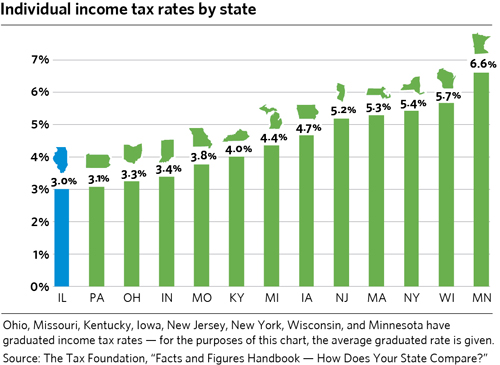

Dusting Off The Income Property Tax Swap Debate Cmap

Dusting Off The Income Property Tax Swap Debate Cmap

How Will Housing Relief From The American Rescue Plan Act Work In Illinois Mansion Global

How Taxes On Property Owned In Another State Work For 2022

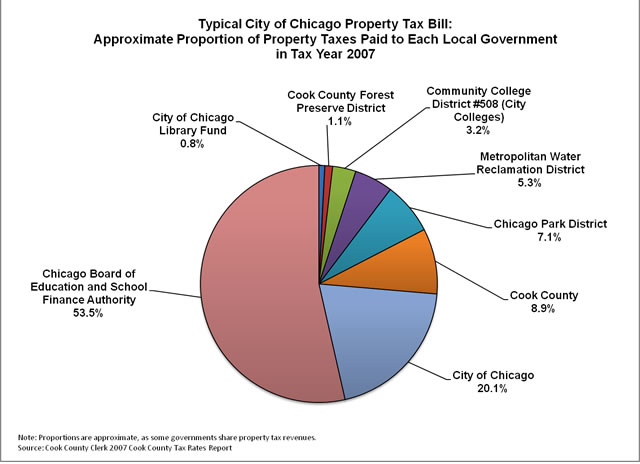

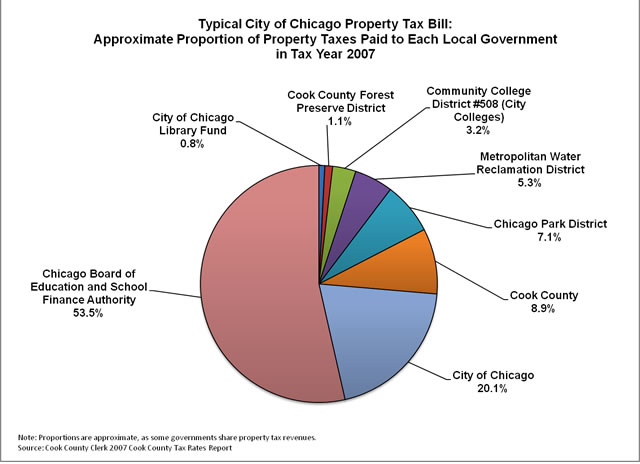

Where Do Your Property Tax Dollars Go The Civic Federation

Disabled Veterans Property Tax Exemptions By State

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr